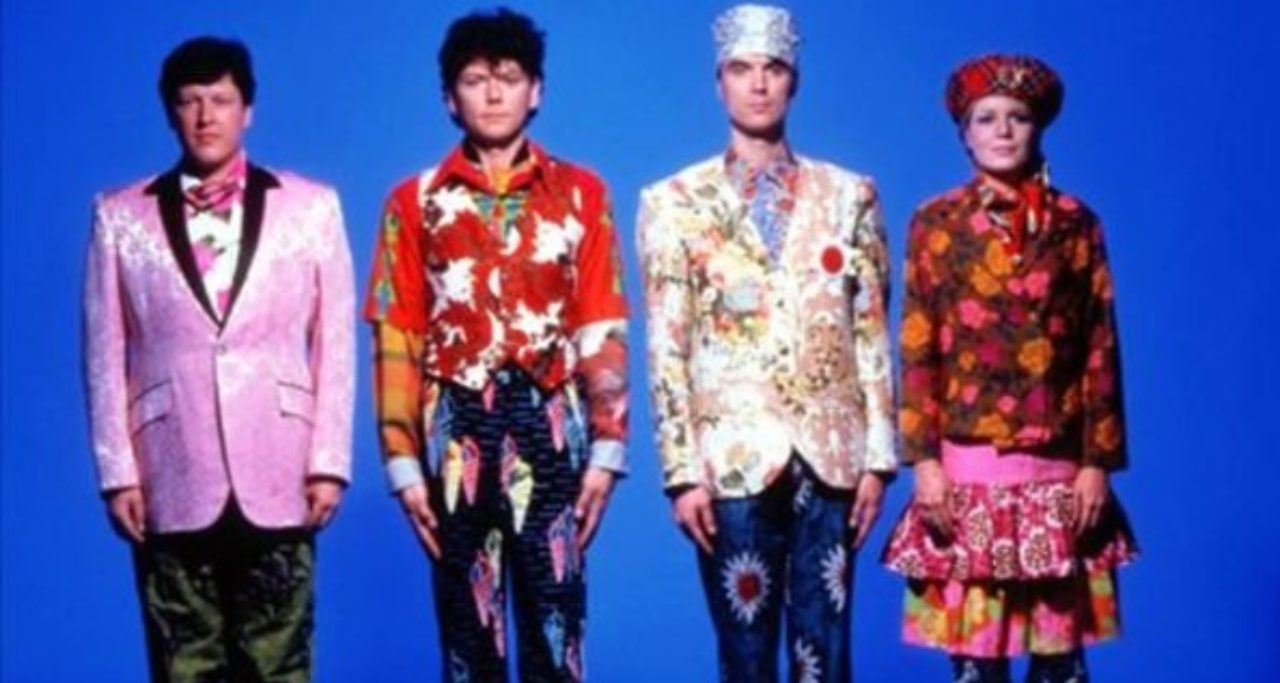

Any Talking Heads fans out there? Right on. Well…how DID I get here? What is FIRE, how did I hear about it, why do I want it?

My husband and I were at a seminar for our business, listening to a “financial advisor” speak, weighing out signing on his dotted line or not. Suddenly, a tiny spark of good sense ignited: google this guy. By a circuitous path, I found a review of him on a site called White Coat Investor (https://www.whitecoatinvestor.com/). Because of that review, we did not sign on the dotted line. But the best part about that search is the whole new world that opened up to me via WCI: there are financial bloggers out there! People, smart people, writing on many topics within this niche. I dove in deep…and promptly began to drown. I had always enjoyed reading about financial themes (The Million Next Door, Dave Ramsey, The Richest Man in Babylon) and fancied myself somewhat knowledgeable. But this was next level: people two to three decades younger than myself already maxing out retirement accounts, investing beyond that, back door Roth-ing it, creating personal investment statements, well on their way to “Financial Independence, Retire Early,” aka FIRE.

Did you catch the “two to three decades younger” part?

I knew things were not optimal for us; although my husband and I have been working hard all these years raising three kids and running his business, many things we did by the seat of our pants. We had no plan beyond taking care of the people who depend on us and trying to “get ahead.” We have been able to provide for our family through some pretty tough situations that required us to dig deep, and many times been the “go to” siblings on both sides of our extended family, providing financial assistance in acute times of need. We donated to our church and other causes we believed in. We stayed – mostly – out of consumer debt. We had bought our own houses and even “flipped” a couple. Somehow this all worked…I think by brute force, really. We always had reasonable cash flow from the business which made it possible. But we had had some major reversals, too: getting swindled out of most of an six figure inheritance by someone we did NOT google, paying for a child’s addictions and mental health issues with both our heartache and pocketbook, buying our “big” house in 2005 and watching 50% of our equity evaporate by the time we sold it in 2010. Oh, and then paying to settle a lawsuit waged by the new owners against us (it’s costly to fight, even when you’re right).

We’ve never been frivolous, but I didn’t even know how much we really spent in a year. Retirement accounts? I thought we had a couple of IRAs, but knew we didn’t regularly contribute. Obviously no pension as self-employed, but didn’t I have something in a State Fund from the 2.5 years I had taught school before having babies? Didn’t know! Health savings account (HSA) for health? Yes, but we always spent whatever we put into it – what’s the point of that? Life insurance? Disability? We had worked with a financial advisor early in my husband’s career who had set up some things for us, but we had tapped into some of it to buy that big house, and I really didn’t even know what was still in place or how much was there. Plus, by the time I discovered the world of financial bloggers and the concept of FIRE, we were well into our 50s. The E train of FIRE had left the station long ago.

What did I know about all this? Sh#@t, that’s what. Talk about a humbling experience. I didn’t even know what the starting point was, let alone how to chart the course or aim the vehicle.

Humility is the beginning then. Humility and insomnia.

Although it may seem obvious, it must be stated: a journey of a thousand miles begins with one step. The first step on this journey was actually first-step-minus-one: deciding to take the journey at all. Deciding to take action despite being terrified of what I would find out, despite fearing I was too late to make a difference. Leaving behind the shame paralyzing me. Discarding any self-image that said I knew what I was doing and didn’t need to learn more. Deciding to quit living each day swept up in wasteful busyness that consumes the only minutes (1440) and hours (24) available to me each day to do my part to get our um…situation…together.

Now the actual step one: I had to figure out where the heck we were. What accounts did we have, and what was in them? What was our total picture IN THAT MOMENT of any retirement accounts, debt, savings? What did we spend on a daily, monthly, yearly basis? What was our average income? We seemed to always have enough, but how much did we have? Bottom line: what were our assets (the monetary value of what we had) and what were our liabilities (what did we owe)? Most of the years of our married life, my husband had paid the bills and done the heavy lifting in getting our “planner” filled out for our accountant to prepare the return. I just assembled information he asked for as best I could, and made myself scarce as he wrestled the numbers. But that arrangement wasn’t going to suffice for this endeavor, and we needed to take action like the grown ups we were.

My record keeping (or lack thereof) was ridiculous. With some really really busy family years and four moves in recent years behind us, I had often employed the “pile” method of record keeping: opening and piling the mail (taking out the bills to pay), and shifting the piles to another room, or ultimately a big Rubbermaid container, when company came. I came by that method naturally, as they say, but I had taken it to a new level. So embarrassing. The room designated as “office” had started to look a little scary. Not like an episode of Hoarders, but just saying… The ice cream cone of shame: I’ll take a triple please. Action step number one: hired a professional organizer. Took us five days, a few tears (going through old stuff is emotional) and a second shredder, when the first one burned out. (I actually found over $6000 during that process, but that’s another story.)

Then it really began. Writing down all our liquid accounts, credit cards, investments, and IRAs, and what was in them. Inputting all of those into a Personal Capital account (https://www.personalcapital.com/) so I could see our actual net worth (oh yay! with our mortgage, triple digit negative for the win). Reading and reading and reading. Reaching out to smarter more experienced people in the financial blogging world for help, learning from the forums and trying hard not to compare, to not play the regret game of “if only we had started this years ago.” Measuring every expenditure with a new eye, cutting what we deemed unworthy of our dollars (I’m looking at you, $1500/year cable bill). Reassessing habits to wake up a new consciousness as spenders, so what we spent on was truly meaningful and valuable to us.

The journey continues. We aren’t at the middle, or even at the end of the beginning. We may be late to the FIRE party, but we’re here. We are traveling forward together. Come with us!